War and Crypto

- Level III Capital

- Mar 15, 2022

- 6 min read

Updated: May 26, 2024

Russia-Ukraine Macro Shockwaves Further Expose Bitcoin as a Risk Asset

Russia’s invasion of Ukraine and the West’s consequential sanctions targeting Russia’s economy are sending ripples across the globe. The conflict is largely symptomatic of an ongoing Russian trend that involves economic, diplomatic, or military conflict with neighboring nation states that are engaged in intensified discussions regarding NATO membership. This behavior can be seen over previous decades in Ukraine (2014), Finland (2009), Georgia (2008), and other nation states. Before the invasion had even begun, inflation was at a thirty year high, the Federal Reserve was undergoing an inflective transition in monetary policy, supply chains were fragile, and equities were suffering. Every asset class is being affected, causing institutions to reevaluate portfolio positions in a realignment with the world sentiment. Investors have turned to risk-off investments in fixed income, government debt, and commodities. That presents the big picture question: in times of uncertainty, how does crypto behave in relation to other global asset classes?

First, let’s take a look at what is most immediately affected to get an anchor in the problem. It seems that just after the extreme global event of Covid-19 in 2020, we have another one on our hands. The brevity of this extreme is found in the world’s dependence on Russias’ output for certain commodities and services. The West is stuck in a hard place between sanctioning Russia for its government’s actions and not completely breaking their own economic foundations.

2021 Russia Exports and Destinations, Source: OEC

The West is one of Russia’s best customers, especially when it comes to energy. However, due to the recent invasion, its oil has effectively become toxic to the West. Energy, metals, and agriculture products are rising in valuation at a rapid rate due to Russia’s significant influence through exports and the existing sanctions or expected ones by the West.

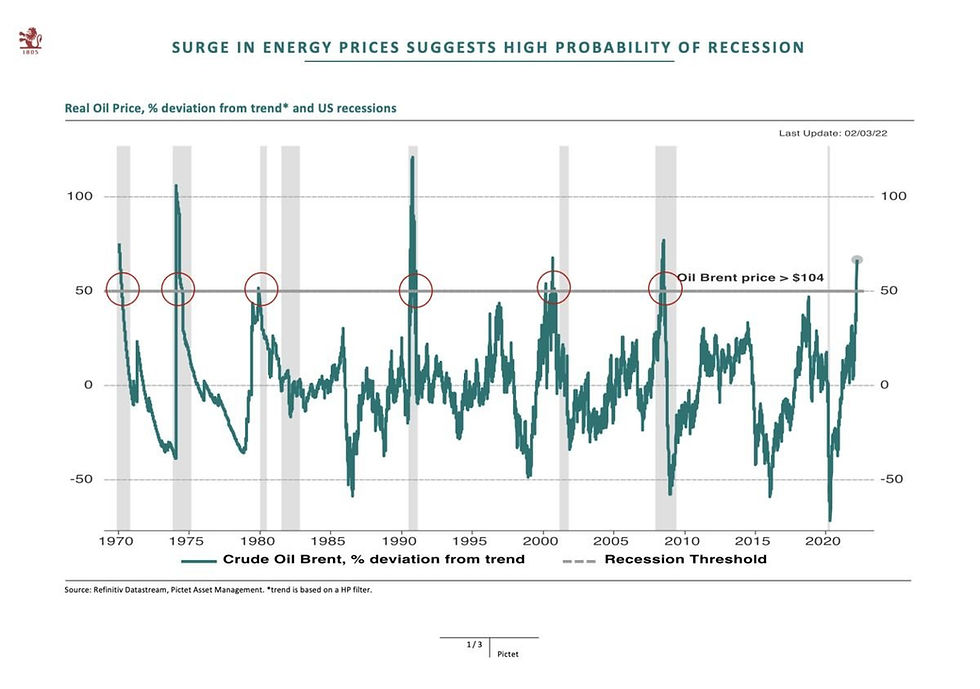

Oil prices are such a hot topic because of the global cross-dependence and correlation to domestic recessions. On top of that, the Federal Reserve is ready and expected to increase the federal funds rate this month. Every U.S. recession since 1971 has been preceded by two things: an energy shock and an increase in the federal funds rate.

Crude Oil and US Recession Comparison, Source: Bloomberg

Given the world’s tremendous dependence on crude oil, higher prices raise both petroleum-based products and alternative sources of energy. If this energy shock were to induce a new recession for the US economy, crypto would find itself in the mix. In a significant way, it already has.

Since the beginning of 2020 and the emergence of Covid-19, Bitcoin has had stronger correlation with the S&P 500 than ever before. During times of uncertainty, which the past few years have characterized, Bitcoin has proven to be a risk-asset in step with equities.

BTC vs. SPX Correlation, Source: Bloomberg

Since July 2021 and following Bitcoin’s price crash of 50% in May 2021, Bitcoin has been moderately to strongly correlated with the S&P 500. When comparing this correlation with price, it can be seen that Bitcoin is more likely to perform well when macro markets are trending and perform poorly when there is uncertainty in direction.

Risk assets are defined by the degree of volatility present in price action. It is no dispute that Bitcoin remains one of the more volatile relevant markets, although we have seen that to decline over the years. While it is expected for volatility to decrease over time, many managers are hoping for a strong decline over the next few quarters. It is a more likely scenario that volatility steadily decreases over many years, almost undetectable by the naked eye.

BTC and Macro Volatilities, Source: CoinDesk

Volatility, however, presents opportunities. This is why actively-managed funds exist to navigate the markets. These types of vehicles will continue to be essential to insitutiitions looking to get exposure crypto without the undesirable qualities of volatility and downside risk.

This information leads us to believe that we can expect Bitcoin to behave as a risk asset from the perspective of volatility for years to come. From the perspective of correlations to other risk assets, such as equities, it will be more concentrated during times of uncertainty.

Crypto’s Global Utility

The war between Ukraine and Russia involves so many global risks that showcase the unbounded utility of crypto during times like these. Let’s take a look at a few of them.

Geopolitical Risk

Russia’s invasion of Ukraine quickly came to NATO attention. Ukraine has been a part of NATO’s “enhanced opportunity partner interoperability program” since June of 2020 in response to Russia’s annexation of Crimea and footprints in the Donbas region. In response to Putin’s actions, countries in the alliance have targeted Russia with debilitating sanctions to isolate and cripple the economy. Major Russian banks have been kicked off the SWIFT international payment system and Russian foreign currency reserves have been frozen.

List of Russian Sanctions, Source: Reuters

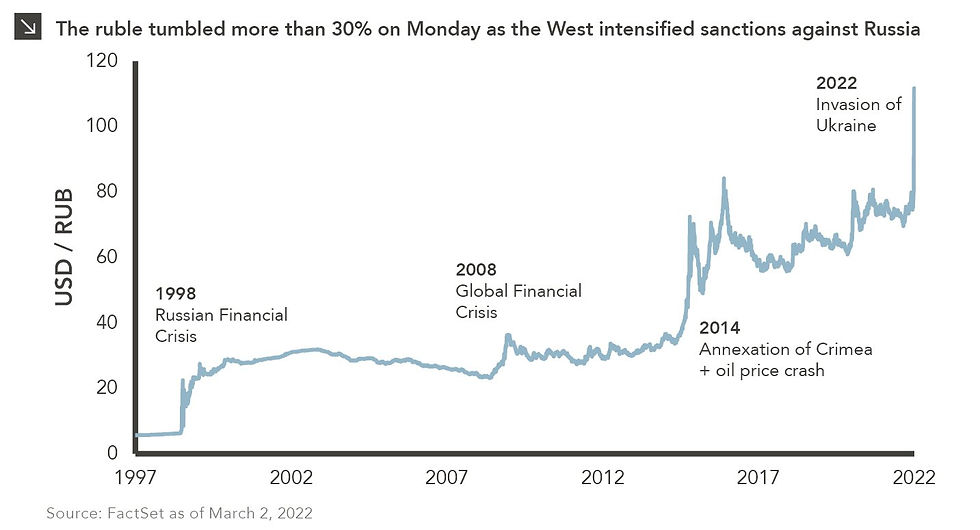

This geopolitical exile had a catastrophic affect on the ruble. This might be biased to say, but there might have been a risk hedging opportunity by holding a form of crypto reserves.

Economic Risk

These new sanctions imposed on Russia and a consequential ban of exports for all raw goods and materials from Russia have sent shockwaves around the globe, as discussed in the previous section. Certain commodities skyrocketed in valuation due to the supply shock, energy appreciated due to renewed demand and supply shock, and the ruble collapsed.

The Russian ruble collapsed after Russia’s invasion of Ukraine and the consequential exile from participation in the SWIFT global payment system. The ruble has lost over 40% of its value since the beginning of the year and experienced a drawdown of greater than 50%. The Russian citizens are the most affected by this rapid devaluation. Their ability to purchase imported products and travel abroad is essentially nonexistent. Fiat currencies are intended to be the safest type of financial assets, yet times like these show the fragility in such a concept.

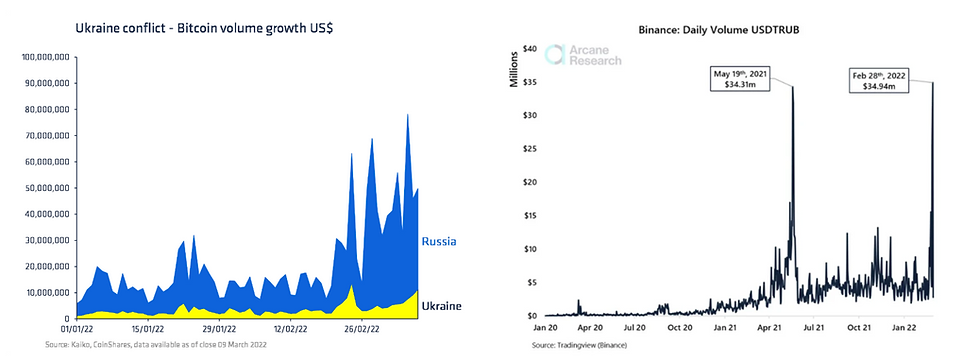

The ruble’s collapsed sparked a tinge of increased activity in Bitcoin (and other cryptoassets) volume growth. During the ruble’s collapse, Russian citizens have been seeking safe haven in foreign currencies, Bitcoin, and stablecoins.

Bitcoin Volume Growth (left), Source: CoinShares. Tether vs. Ruble Volume (right), Source: Arcane Research

Citizens involved in the conflict have converted to cryptoassets for a few reasons, with the first being that they are not the ruble. Crypto provides the ability for easy cross-border transactions with instant settlement. This is essential for both Ukrainian and Russian citizens. Either their financial infrastructure is in jeopardy or the there are limits on fiat currency withdrawals. The demand comes from the increased financial freedom that is embedded in the technology of crypto. It allows the ability to transact without having to rely on a government or authority. Consequently, citizens are financially protected from a government’s decisions.

Societal Risk

A large part of state-backed currency downsides are in the physical and economic nature of it during a time of crisis. Since the conflict began, Russian citizens are waiting in long lines to deposit fiat currency only to learn that a government will do all it can to preserve the integrity of its currency at all costs. Ukrainian citizens are also finding themselves in long lines for ATM deposits due to the fear of bank runs that can prompt bankruptcy, lending shortages, and more.

Crypto came in handy when Ukraine needed to raise capital. In a form of crowd raising, the Ukraine twitter account setup wallets for Bitcoin, Ethereum, and Tether. Shortly after, other assets such as Polkadot and Dogecoin.

Ukraine Donation Tweet, Source: Twitter

Ukraine has received "close to $100 million" in crypto donations, according to Alex Bornyakov, Ukraine’s deputy minister at the Ministry of Digital Transformation. These donations are being used on fuel, food, and equipment for soldiers.

Crypto Contributions to Ukraine State-Owned Kuna Wallet, Source: Dune Analytics

Given this information on the various risks that present themselves during a time of calamity, it’s safe to assume that crypto’s utility as a means of payments is in higher demand. It raises the question: does this demand correlate to price? The answer is not individually, but rather demand in step with supply. As discussed in a previous Level III Crypto Letter, we are still in the middle of a halving cycle. The next supply shock for Bitcoin will not come until early 2024. Seeing this, it is possible that recent demand might be the only thing holding up the valuation. Regardless of the perspective or price, crypto is being utilized on a global scale for its utility function that is unique to every other technology that exists. That alone should garner attention from the world.